Car title loans Hillsboro TX offer quick funding secured by your vehicle's title. Requirements include ID, proof of income, and clear car title. Loan amounts vary based on vehicle value, with terms from 30 days to years. Maintaining your vehicle's condition secures better terms and prevents repossession. Evaluate financial situation thoroughly before applying.

In Hillsboro, Texas, car title loans offer a unique opportunity for quick cash access secured by your vehicle. If you’re considering this option, understanding the available loan amounts and requirements is crucial. This article delves into the intricacies of car title loans Hillsboro TX, explaining the diverse loan amounts on offer and how to maximize your vehicle’s value. By exploring these aspects, borrowers can make informed decisions, ensuring they unlock the most suitable funding for their needs.

- Understanding Hillsboro TX Title Loan Requirements

- Unlocking Funds: Loan Amounts and Terms Explained

- Maximizing Your Car's Value in Title Loans Hillsboro TX

Understanding Hillsboro TX Title Loan Requirements

When considering a Car Title Loan Hillsboro TX, understanding the requirements is a crucial first step. These loans are unique financial instruments that use your vehicle’s title as collateral. This means lenders offer a certain amount based on your car’s value, and you retain ownership during the loan period. The application process involves providing identification, proof of income, and a clear car title to establish your eligibility. Lenders in Hillsboro TX may also conduct a brief credit check, but they are more focused on the condition of your vehicle and your ability to repay than your credit score.

One significant advantage of Car Title Loans Hillsboro TX is that they provide an easy way to access emergency funds without a traditional credit check. This makes them an attractive option for those seeking quick financial assistance when unexpected expenses arise. As long as you have a valid driver’s license and a clear title, you could potentially secure the loan amount needed to cover urgent costs, giving you time to get back on your feet financially.

Unlocking Funds: Loan Amounts and Terms Explained

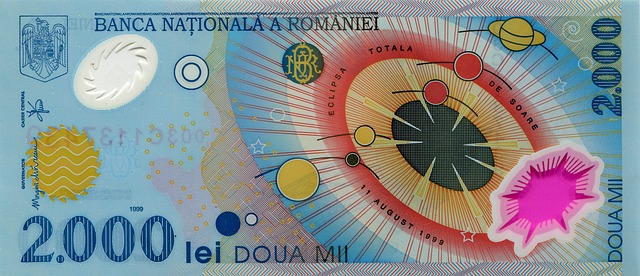

When considering a Car Title Loan Hillsboro TX, understanding the available loan amounts and terms is crucial for making an informed decision. These loans are unique compared to traditional lending options as they use your vehicle’s title as collateral, which can provide faster access to funds. The amount you can borrow typically depends on the value of your car, with lenders offering a percentage of its overall worth. This process is known as the Title Loan Process, where lenders assess your vehicle’s condition and current market value to determine the maximum loan amount eligible for.

The loan terms vary, but they generally range from 30 days to a few years. Short-term loans have higher interest rates but may be suitable for immediate financial needs, while longer terms offer lower monthly payments but can result in paying more over time. Houston Title Loans, for instance, often cater to various borrower preferences with flexible repayment plans. It’s important to evaluate your budget and choose a term that aligns with your ability to repay without incurring excessive fees or interest charges.

Maximizing Your Car's Value in Title Loans Hillsboro TX

When considering Car Title Loans Hillsboro TX, maximizing your vehicle’s value is crucial. This involves ensuring your car is in excellent condition, as lenders will appraise it to determine its equity. Regular maintenance, including timely repairs and washes, can significantly boost its market value. Additionally, keeping a clean driving record and paying all outstanding car-related debts can improve your credit score, which might lead to better loan terms.

Emergency funding needs often drive individuals to explore Car Title Loans Hillsboro TX. Utilizing the equity from your vehicle as collateral provides access to immediate capital. However, it’s essential to consider that if you’re unable to repay the loan, the lender may repossess your car. Thus, evaluating your financial situation and understanding the repayment terms before pledging your Vehicle Collateral is vital to avoid potential losses and maintain ownership of your asset.

Car title loans Hillsboro TX can provide a quick solution for those needing cash. With flexible loan amounts dependent on your vehicle’s value, these loans offer a straightforward path to funding. By leveraging your car as collateral, you gain access to immediate funds without the stringent requirements of traditional loans. Maximize your vehicle’s worth and unlock the financial support you need today with a Hillsboro TX car title loan.