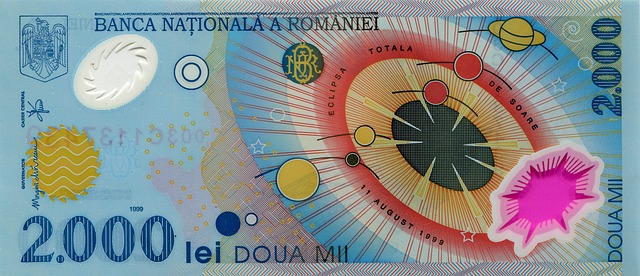

Car title loans Hillsboro TX provide a fast and secure financing alternative for individuals who own a car. By using the vehicle's title as collateral, these loans offer quicker approvals and less stringent requirements compared to traditional bank loans, making them accessible even for those with poor credit or limited banking access. The process involves submitting an application, inspecting the car's value, and using direct deposit for funding, with minimal documentation needed—including no credit check. If the borrower defaults, the lender can legally repossess the vehicle.

In today’s digital era, understanding financial options is crucial for navigating life’s challenges. Car title loans Hillsboro TX have emerged as a game-changer for many, offering quick access to cash secured by your vehicle. This article delves into the world of car title loans, comparing them to home equity loans and exploring their pros and cons. By examining the mechanics, key differences, and real-world applications, you’ll gain insights into the best fit for your financial needs in Hillsboro, TX.

- Understanding Title Loans and Their Mechanics

- – Definition of car title loans

- – How they work: Lender's perspective

Understanding Title Loans and Their Mechanics

Title loans, particularly Car title loans Hillsboro TX, are a unique type of secured loan where borrowers use their vehicle’s title as collateral. This alternative financing option is designed for individuals who need quick access to cash and may not qualify for traditional bank loans. The mechanics behind these loans involve a straightforward process. Borrowers submit an application providing details about their vehicle, including the make, model, year, and mileage. Once approved, the lender conducts a brief inspection of the car to verify its condition and value.

If the vehicle meets the lender’s criteria, they will disburse the loan amount directly to the borrower. Unlike unsecured loans, where approval is primarily based on creditworthiness, secured loans like title loans hinge on the collateral—in this case, the vehicle’s title. This ensures lenders have a form of protection against default, often resulting in faster loan approval times and less stringent borrowing requirements.

– Definition of car title loans

Car title loans Hillsboro TX are a type of secured lending where borrowers use their vehicle’s title as collateral to secure a loan. This alternative financing option is designed for individuals who own a car and need quick cash. In this arrangement, the lender holds the title to the vehicle until the loan is repaid in full. Car title loans can be particularly appealing to those with poor credit or limited banking options, as they often offer more flexible requirements compared to traditional loans.

Unlike home equity loans, which rely on the borrower’s property ownership and may involve a lengthy application process with strict credit checks, car title loans have simpler loan requirements. The primary focus is on the value of the vehicle rather than the borrower’s financial history. This makes them a viable option for folks seeking rapid access to cash without the usual hurdles associated with conventional borrowing methods.

– How they work: Lender's perspective

From the lender’s perspective, car title loans Hillsboro TX operate on a straightforward principle. The process begins when a borrower brings in their vehicle’s title as collateral. The lender assesses the vehicle’s value and offers a loan amount based on that assessment. Once agreed upon, the borrower receives the funds directly through a direct deposit, making it a swift transaction. The key differentiator is that these loans are secured by the car title, meaning if the borrower defaults, the lender has the legal right to repossess the vehicle.

This type of loan is particularly appealing for individuals seeking quick cash and who own a vehicle with significant equity. Unlike traditional home equity loans, car title loans require minimal documentation and have more flexible requirements, often including no credit check. This makes them an attractive option for those looking to consolidate debt or cover unexpected expenses without the stringent conditions typically associated with other loan types.

When considering a car title loan Hillsboro TX, understanding your options is key. While both car title loans and home equity loans offer financial support, they operate differently. Car title loans are secured by your vehicle, providing quick access to cash with simpler eligibility requirements. In contrast, home equity loans leverage your home’s value, often offering lower interest rates but with more stringent criteria. Evaluating these options based on your financial needs and circumstances can help you make an informed decision tailored to your situation.